Ethereum Price Prediction: Institutional Accumulation Points to New Highs Above $4,900

#ETH

- ETH trading above 20-day MA at $4,288 suggests bullish technical structure

- Record institutional treasury expansions totaling over $7 billion indicate strong fundamental demand

- Upper Bollinger Band at $4,897 provides near-term technical target with regulatory tailwinds supporting momentum

ETH Price Prediction

Technical Analysis: ETH Shows Bullish Momentum Above Key Moving Average

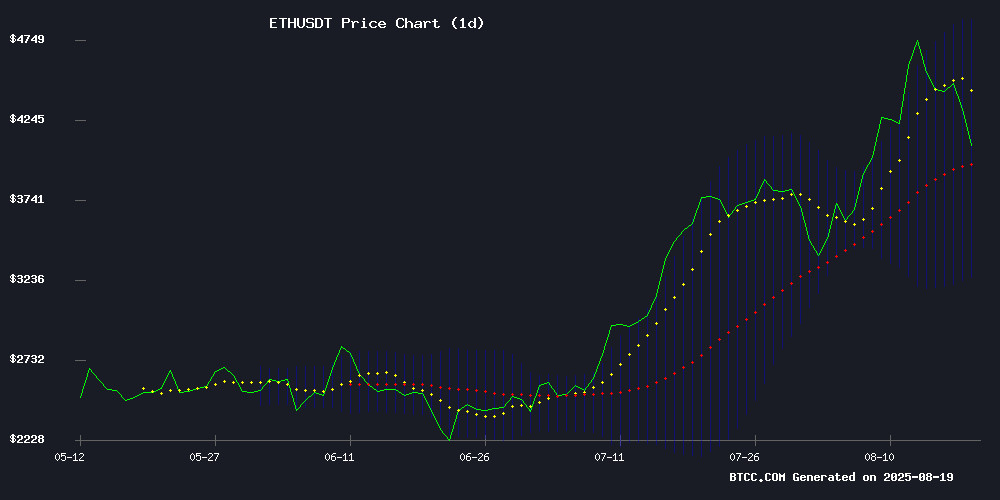

Ethereum is currently trading at $4,288.12, comfortably above its 20-day moving average of $4,078.47, indicating sustained bullish momentum. The MACD reading of -429.37 suggests some near-term bearish pressure, though the histogram shows improving momentum at -124.58. According to BTCC financial analyst John, 'ETH's position above the middle Bollinger Band at $4,078.47, with room to approach the upper band at $4,897.27, suggests potential for further upside movement in the coming sessions.'

Institutional Demand and Regulatory Developments Support ETH Outlook

Recent developments show sustained institutional interest despite short-term price corrections. BitMine's expansion of its ethereum treasury to $6.6 billion and ETHZilla's Nasdaq debut with a $419 million treasury strategy demonstrate growing corporate adoption. BTCC financial analyst John notes, 'The record validator exit queue and $3.9 billion ETH leaving the network actually reflect institutional accumulation rather than selling pressure. Japan's approval of the first yen-based stablecoin further validates Ethereum's infrastructure role in global finance.'

Factors Influencing ETH's Price

CryptoZoo Buyers Lose Legal Battle Against Logan Paul as Court Dismisses Majority of Claims

A Texas magistrate judge has dealt a significant blow to investors seeking recourse against YouTube personality Logan Paul over his failed NFT venture, CryptoZoo. Magistrate Judge Ronald Griffin recommended dismissing the bulk of a class-action lawsuit, citing insufficient evidence linking Paul directly to investors' financial losses.

The ruling permanently rejected claims of commodity pool fraud, with the judge characterizing plaintiff arguments as convoluted. This development follows Paul's earlier offer to refund buyers 0.1 ETH each—approximately $2.3 million set aside—in exchange for legal immunity.

The collapsed NFT project, which promised unfulfilled features and rewards, now faces parallel legal drama as Paul pursues defamation claims against commentator Coffeezilla for coverage of the controversy.

Chamath Palihapitiya Launches $250M SPAC Targeting DeFi and AI Sectors

Venture capitalist Chamath Palihapitiya has filed for a new $250 million special purpose acquisition company (SPAC) after a two-year hiatus from blank-check firms. The American Exceptionalism Acquisition Corp A aims to merge with companies in artificial intelligence, decentralized finance (DeFi), defense robotics, and energy sectors. The SPAC will trade under ticker AEXA on the NYSE and has 24 months to identify a merger partner.

Palihapitiya's return to SPACs follows the shuttering of two vehicles in 2022 due to failed merger attempts. The new structure eliminates warrants and ties founder share vesting to a 50% stock price increase above the $10 IPO price. He argues DeFi's next growth phase hinges on deeper integration with traditional finance, pointing to Circle's success as a blueprint.

The filing comes as Palihapitiya's previous SPACs—including Opendoor, Virgin Galactic, and Clover Health—continue to trade below their debut prices. Market observers will watch whether this vehicle can buck the trend of declining SPAC performance amid tighter regulatory scrutiny.

BitMine Expands Ethereum Treasury to $6.6B Amid Stock Decline

BitMine Immersion Technologies has aggressively expanded its Ethereum holdings, adding 373,000 ETH in a single week to reach 1.52 million tokens—equivalent to 1.3% of the circulating supply. At current valuations, the $6.6 billion treasury cements BitMine's position as the largest corporate holder of Ethereum.

The accumulation strategy contrasts sharply with the company's stock performance, which dropped 14.2% during the same period. Market observers note the divergence reflects investor skepticism about BitMine's planned $24.5 billion stock sale to fund additional ETH purchases under its 'alchemy of 5%' strategy.

Institutional interest in Ethereum appears resurgent, with spot ETH ETFs recording $17 billion in weekly volume. 'Ethereum is becoming the foundational layer for Wall Street's next-generation financial infrastructure,' noted company spokesperson Marcy Simon, highlighting growing institutional engagement with smart contract platforms.

Ethereum Retreats From Near-Record High Amid Institutional Demand

Ethereum's price pulled back to $4,280 after testing resistance near its 2021 all-time high of $4,878, marking a 5.7% decline. The retreat comes despite record-breaking inflows into US-listed spot Ether ETFs, which accumulated 649,000 ETH last week—a clear signal of sustained institutional interest.

Technical analysts note critical liquidity zones between $3,900 and $4,400, with some suggesting a retest of lower support could precede a potential rally toward $8,000. Futures markets show retail participation reaching overheated levels, though flat funding rates indicate the recent surge was driven by spot buying rather than excessive leverage.

Ethereum Validator Exit Queue Hits Record High Amid Sustained Institutional Interest

Ethereum's Proof-of-Stake network is experiencing unprecedented validator exit activity, with 910,000 ETH ($3.8 billion) currently queued for withdrawal. The backlog requires nearly 16 days to process—the longest delay since the Shapella upgrade enabled staking redemptions.

Concurrent with exits, fresh capital continues entering the system. The deposit queue holds 260,185 ETH ($1.1 billion) awaiting activation within 4.5 days, demonstrating resilient institutional demand that stabilizes the staking ecosystem.

Network metrics reveal 1.082 million active validators securing 35.5 million ETH—29.38% of total supply. Current staking yields average 2.95% APR, a competitive rate despite the exit surge following Ethereum's 70% price appreciation year-to-date.

Crypto Ransom Hoax Targets 32 Delhi Schools with Bomb Threats

At least 32 schools in Delhi were thrown into chaos after receiving coordinated bomb threats via email. The cyber group, calling itself 'The Terrorizers 111 Group,' demanded $5,000 in Ethereum (ETH) and claimed to have planted explosives across multiple campuses. The Delhi Police confirmed the threats were a hoax after thorough searches revealed no suspicious items.

The group's email included dire warnings, urging immediate evacuation and threatening to detonate bombs unless the ransom was paid within 72 hours. They also claimed to have hacked school IT systems, stolen sensitive data, and gained control of surveillance networks. Cyber forensic teams are now working to trace the sender's IP address.

Affected schools include Global School, BGS International, and Shri Ram International, among others. The incident highlights the growing misuse of cryptocurrency in cybercrime, though authorities swiftly debunked the threats.

Ethereum Sees Record Validator Exodus as $3.9B ETH Leaves Network

Ethereum's proof-of-stake network is experiencing an unprecedented validator exit wave, with over 910,000 ETH—worth nearly $3.91 billion—queued for withdrawal. Validatorqueue data reveals this as the largest-ever exodus, while 268,000 ETH await entry, highlighting a stark divide between profit-takers and new stakers.

The validator queue, a balancing mechanism for Ethereum's staking system, swelled past 893,000 ETH on Aug 17, 2025, representing 2.5% of all staked ETH. Processing this backlog would take 14.5 days at current speeds. Early stakers, many of whom entered at $1,000-$2,000 ETH prices, are now capitalizing on the asset's $4,400+ valuation.

Structural shifts are also driving exits. Smaller validators, who initially staked the minimum 32 ETH, are reorganizing to accommodate institutional preferences for larger, cost-efficient validator slots. This transition necessitates temporary withdrawals, further inflating the queue.

ETHZilla Debuts on Nasdaq with $419M Ethereum Treasury Strategy

ETHZilla Corporation, rebranded from 180 Life Sciences Corp., commenced trading on the Nasdaq Capital Market under the ticker ETHZ on August 18, 2025. The company has pivoted to become a dedicated Ethereum accumulation vehicle, marking a significant shift from its biotech origins.

The firm holds 94,675 ETH acquired at an average price of $3,902.20, totaling $419 million in digital assets. This strategic move follows a $425 million private placement and $156.25 million convertible note offering. ETHZilla retains $187 million in cash reserves, balancing aggressive ETH accumulation with financial flexibility.

Nasdaq listing provides institutional investors with regulated exposure to Ethereum's growth potential. The rebrand reflects growing corporate interest in cryptocurrency treasury strategies, mirroring MicroStrategy's Bitcoin-focused approach but with an ETH-centric vision.

Ethplorer Emerges as Key Tool for Navigating Ethereum's Expanding Ecosystem

As Ethereum's network evolves beyond its ERC-20 roots into a complex web of DeFi protocols, DAOs, and tokenized assets, Ethplorer has positioned itself as an indispensable blockchain explorer. The platform offers real-time transaction tracking, historical token analytics, and API integration capabilities that surpass standard Ethereum explorers.

With Ethereum's Pectra upgrade enhancing wallet functionality, Ethplorer's notification system has gained strategic importance for traders monitoring token flows, developers debugging contracts, and analysts tracking capital movements. The explorer provides granular visibility into smart contract interactions across an ecosystem processing billions in daily value.

Japan Approves First Yen-Based Stablecoin for Global Finance

Japan's Financial Services Agency (FSA) is set to greenlight the country's inaugural yen-pegged stablecoin, JPYC, marking a significant milestone in digital finance. The Ethereum-based asset aims to streamline cross-border payments while maintaining a 1:1 peg to the yen.

JPYC Inc., the issuing entity, will register as a money transfer service by month-end. The company plans to circulate $7 billion worth of the stablecoin within three years, leveraging blockchain's transparency for financial innovation. The move positions Japan as a pioneer in regulated stablecoin adoption.

Beyond domestic use, JPYC targets international remittances with potential cost and speed advantages. Market observers note this development could accelerate cryptocurrency integration in traditional finance, particularly benefiting Ethereum's ecosystem.

Ethereum Price Correction Tests Market Resilience Amid Institutional Support

Ethereum's 6% retreat from $4,700 to $4,400 triggered cascading liquidations across DeFi altcoins, though blockchain analytics reveal stable whale accumulation patterns. The pullback follows ETH's near-retest of its $4,788 record, with derivatives data showing open interest remaining elevated at $9.2 billion—a sign of persistent institutional interest.

BlackRock's ETH spot ETF now holds 362,000 tokens ($1.6 billion), creating structural demand that's cushioning downside volatility. Technical analysts identify $4,100 as critical support, with the 30-day volatility band tightening to levels last seen before July's 28% rally. Price prediction markets still assign 64% odds of a $5,000 breakout before month-end.

Meanwhile, Remittix's RTX token sale has attracted $19.8 million for its cross-border payment infrastructure, reflecting continued appetite for blockchain solutions in traditional finance corridors. The project's PayFi architecture demonstrates real-world adoption potential beyond speculative trading.

How High Will ETH Price Go?

Based on current technical indicators and fundamental developments, ETH appears poised for a move toward the $4,897 upper Bollinger Band resistance level. The combination of strong institutional demand through treasury acquisitions and positive regulatory developments creates a supportive environment for higher prices. However, traders should monitor the MACD for any divergence that might signal short-term consolidation before the next leg higher.

| Resistance Level | Price Target | Probability |

|---|---|---|

| Upper Bollinger Band | $4,897 | High |

| Psychological Resistance | $5,000 | Medium |

| Previous High | $5,200+ | Low-Medium |